|

|

登入後,內容更豐富

您需要 登錄 才可以下載或查看,沒有賬號?註冊

×

本帖最後由 jgyjgw 於 2017-7-4 00:26 編輯

德國外匯市場正試圖向股市投資者發出信號, 牛市正在減緩, 股市狂跌之前的影子, 信不信由你吧.

[轉載, 英文, 待板主老大翻譯吧]

German bunds are trying to deliver a message to stock-market investors: Achtung!

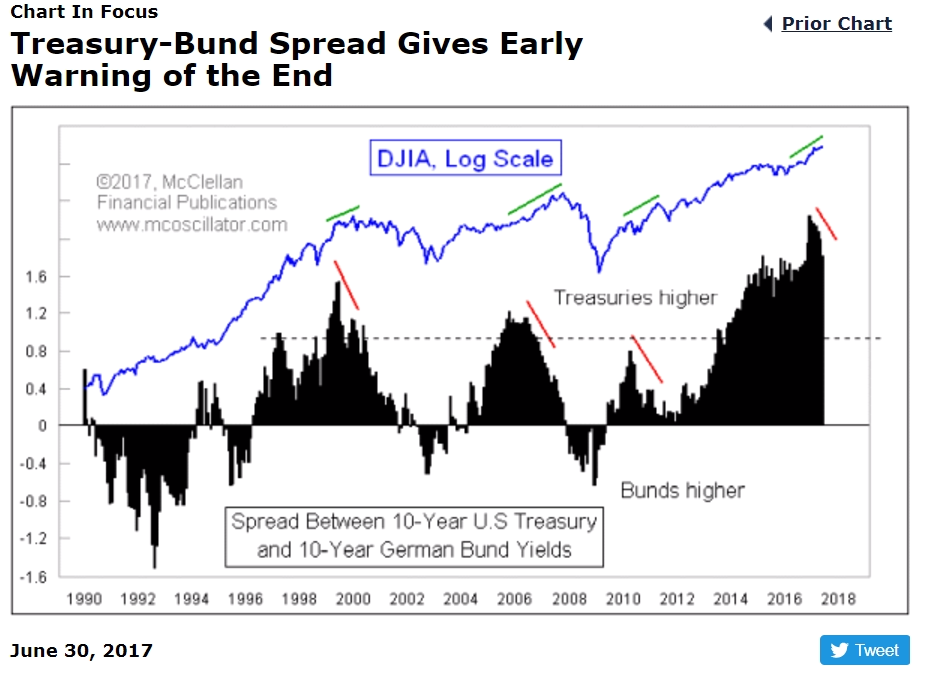

According to market technician Tom McClellan, a narrowing yield spread between German 10-year bonds, known as bunds TMBMKDE-10Y, +1.73% and their U.S. counterpart TMUBMUSD10Y, +3.17% has historically been a bad omen for equity markets.

The yield differential between bunds, which were carrying a negative yield about a year ago and reached a record spread—2.38 percentage points—on Dec. 28 with U.S. 10-year paper, has been on a tightening trend lately, illustrated by one McClellan chart (看圖)

Source: McClellan Financial Publications

How is a narrowing spread in German bond yields a problem for U.S. stocks?

As McClellan explains it, a rising yield premium between German and U.S. government paper tends to be a market condition that has historically been supportive to higher moves in the Dow Jones Industrial Average DJIA, +0.85% S&P 500 SPX, +0.48% and Nasdaq Composite Index COMP, -0.21%

Ever since June 2009, the yield on the US 10-year T-Note has been higher than its German counterpart. It turns out that this is a pretty bullish condition, at least for as long as the spread between the two is rising. As a bull market ages, though, this spread shows the wearing out by displaying a divergence relative to prices. It can take many months for the divergence to finally matter, and bring a meaningful price decline. We are just now starting to see those first signs of such a divergence

McClellan’s chart shows that after a speak bund/Treasury spread, which has occurred in 1999, 2000, and 2010, equity markets unraveled [股市狂跌]. It isn’t’ clear why this pattern has played out, but the market technician says the relationship has only been an effective predictor, albeit with some delays, since the 1980s.

The ominous bond pattern should be taken with a grain of salt, but it comes as Wall Street has closed a tumultuous week for fixed-income investors, following comments from global central bankers, including European Central Bank boss Mario Draghi, that may have stoked fears that easy-money policies, which have underpinned stock and bond valuations during this eight year-old bull market, are nearing an end.

Although it isn’t certain, ultralow yields may be behind us and the road ahead, despite signs of healthy but stuttering economic growth and stalled-out inflation, appears hazy—at least to some bears.

That uncertainty helped to fuel a selloff in the bond market this week and reignited dormant volatility in stock benchmarks that have been scaling new heights at a record clip. Risk is back on the table and investors ought to be mindful of complacency. That is particularly true within the perceived safety of bonds that have enjoyed their own extended bull run.

But last week’s Treasury moves should be a reminder of so-called duration risk, which can gut Treasury holders and bond-fund managers, who may be ill-prepared for sharp swings in bonds. For example, yields in 10-year paper saw a weekly climb of about 15 basis points, marking its biggest yield jump since March, according to WSJ Market Data Group. The 30-year bond climbed by about 12 basis points. Bond prices and yields move in opposite directions.

Those yield moves translate to a weekly price drop of about 1.5% for the 10-year, while the long bond slumped by a little mover 3% during the same period.

|

|